Penalties can land you back in the guest seat. Death and injury are the highest rate motorists can spend for drinking and driving, but even if you handle to endure, a D.U.I. ticket will cost teenagers huge time. As a teen chauffeur, you'll likely be cancelled and if you can get insurance coverage, expect to pay a much higher rate for the next 3-5 years.

Drive an "insurance coverage friendly" car. Cars and trucks that are a favorite target for burglars, are costly to repair, or are considered "high performance" have much higher insurance coverage expenses.

Excitement About Ways To Reduce The Cost Of Insurance For Teens In New Jersey

Frequently Asked Questions About Auto Insurance Coverage A.

No. You need to have a legitimate chauffeur's license. In many states, you need to be 18 before you can own a car without a grownup's name on the vehicle registration. A. Auto insurance coverage policies usually last 6 months. Some last one year. You will get a notice when it's time to restore your insurance coverage.

Getting My 15 Tips And Ideas For Cutting Car Insurance Costs - Investopedia To Work

A. Under many situations, someone using your automobile with your approval is covered by your insurance coverage. If the person borrows your car with your consent and is associated with a mishap, your insurance coverage will pay just as if you were the chauffeur. In some states, some insurance providers might limit the coverage.

In this example, a young driver could see the cost of their insurance more than double after one ticket and one mishap. Just to stress, the company used much better than average protection for our rate examples, not barebones protection, so they are not the company's most affordable rates. All are based upon the teen driving a 2003 Honda, regular usage.

At What Age Do Car Insurance Rates Go Down? - Money ... Fundamentals Explained

If you have an older automobile with low market value, it might be a great idea to lower your premium by eliminating accident protection. When you provide your car to someone and they trigger a mishap, it is their automobile insurance coverage that will cover the damages on your automobile.

Discounts aren't the only way to save on your teenager's cars and truck insurance coverage. Buy an older car The expense of an automobile helps figure out the expense of your insurance, so get your teen an older, less costly car.

Rumored Buzz on Young Driver Car Insurance - Consumer Coverage

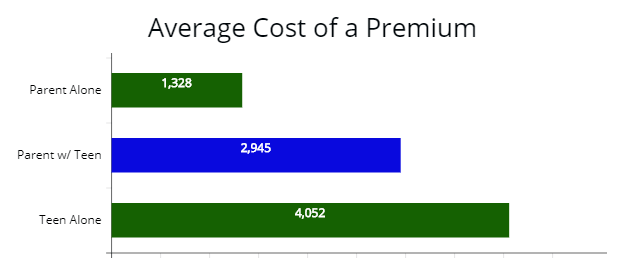

It also comes from your automobile insurance coverage premium boost when you include a teen chauffeur to your policy. Learn about adding a teen motorist to your policy and some business that provide discount rates on auto insurance coverage.

Some automobile insurance provides some safe driving discounts to teens who finish a teen driving course. You may even discover business that utilize both driving courses and excellent grades as discount rates.

The Ultimate Guide To How To Add A Teen Driver To Your Car Insurance - Reviews.com

You may likewise be able to combine other insurance plan or bundle your insurance to reduce your expenses. Talk to your insurance coverage agent to discover out if there are other strategies you can utilize to lower your insurance coverage premiums. You may believe about trying to find another company. You might be able to find much better prices with another company for your whole family.

You need to think about the protection you are getting, the cost you pay for it, and the insurance coverage company's credibility. Business That Deal Teen Safe Driving Discounts Here are some of the various safe driving programs and discount rates from leading car insurance companies. AAA Insurance Coverage AAA Insurance coverage has a teen safe driver plan that could save you some money.

8 Ways To Cut Insurance Costs For Teen Drivers - Kiplinger Fundamentals Explained

It keeps an eye on hard braking, acceleration, night driving, and range. If it's in the automobile your teen drives and they drive securely, you might see a discount of up to 40%.

Bundling your insurance coverage with one supplier is a terrific way to reduce your insurance costs, even with a teen driver. State Farm State Farm has several choices that can assist lower the costs after including a teen motorist.

Average Cost Of Car Insurance For 16-year-olds - Valuepenguin Fundamentals Explained

If your college trainee is at school, and the car is only utilized while they are home during breaks, a discount rate is provided until they are 25 years of ages. In its "Guide Clear" program, State Farm has five training modules. The modules have lessons, videos, and some quizzes. Your teenager is then asked to drive at least 10 journeys with a mentor that totals 5 hours of driving time.

When the program is total, your teen gets a certificate that you can send out to your representative for a discount rate. State Farm also states you may be able to lower your insurance coverage expense by ensuring the vehicle your teen drives has the most current security options and is a cheaper design.

Some Known Questions About 6 Reasons Why Auto Insurance Costs More For Young Drivers ....

For moms and dads, the excitement of having a first-time driver in your house is normally tempered with worry. With little driving experience, immature chauffeurs are at a higher threat for accidents. Obviously, safety issue is uppermost in a lot of moms and dads' minds however other stressorslike the high cost of insuring your new motorist and the financial liability ramifications of a teen driving mishapcan be lowered with these actions.

Motivate favorable behaviors Car insurance providers provide discounts or minimized premiums to: Students who keep a minimum of a "B" average in school Teenagers who take a recognized chauffeur training course University student who attend school a minimum of 100 miles away from home and do not bring their cars and truck to campus Pick the best auto insurer It's normally less costly for parents to add teens to their automobile insurance coverage policy than it is for teens to purchase one on their own.