Are products taken from your car covered by insurance coverage? Whether you just require to replace your secrets or you had your laptop computer in the trunk of the car, you can submit an insurance coverage claim to change those items but not with your automobile insurance. The products in your car are covered under your renters insurance or property owners insurance coverage, which means you would need to file a different claim for stolen home under the proper insurance.

Does cars and truck insurance cover taken car secrets? Vehicle insurance coverage normally only cover lost keys if they were lost due to a covered danger, such as theft. However, your comprehensive protection may or may not consist of protection for taken cars and truck keys depending upon the benefits included in your policy. Check your advantages thoroughly to see if stolen automobile keys are covered by your insurance coverage.

The brief response is no, car insurance will not cover your personal belongings. This can be a problem if you leave something important such as a laptop computer in your vehicle and the laptop computer or the entire car is taken. It is necessary to be familiar with what is covered and what isn't.

The Facts About How To Report A Stolen Car - Your Aaa Network Uncovered

Comprehensive coverage is what pays for your taken vehicle. Your auto insurance coverage covers any items that are permanently connected to your automobile, such as a dash navigation system that included the vehicle. Portable and removable products such as an external GPS do not fit into this classification. Your insurer should know whatever on your car, so if you included a stereo to your car, you need to have actually informed your agent about the upgrade prior to the theft.

While it sounds weird, your homeowners or tenants insurance really could help you recover taken items from your car. If you have proof that you owned the products that were lost when your car was stolen such as receipts, your individual valuables must be covered. You will have to submit a police report and follow all main procedures prior to you can reach a settlement and gather from your insurance coverage.

The very best practice for unattached valuable products is to never leave them in your lorry. For included attached items, simply make certain that your insurer knows them and ask if you need an unique recommendation for them to be covered. For excellent rates on cars and truck insurance coverage, call one of our certified representatives today at or visit our for a totally free quote!.

The Best Guide To Frequently Asked Questions About Auto Insurance Claims

Theft of your car is covered under thorough (besides accident) insurance. Theft of the products in your vehicle would not be covered by your automobile policy, however might be covered under your homeowners policy. If your automobile is stolen, you must notify the authorities as quickly as possible. Stopping working to alert the authorities could affect the result of your claim.

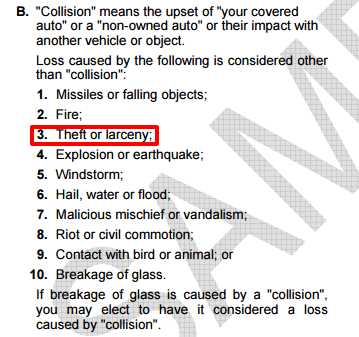

What Comprehensive Insurance Coverage Does not Cover Items stolen from your car Vehicle insurance coverage does not cover items taken from your vehicle, unless they belong to the automobile. Your policy might cover the car's original radio or its hubcaps, but it wouldn't cover the laptop you left on the seat or GPS in the glove compartment.

Leaving your keys in the automobile? Lugging your secrets around can be a trouble, so you drop them into your automobile's cupholder or tuck them on top of your visor.

All about Stolen Vehicle Assistance Feature Information - Onstar

However will your insurance provider cover it although they (and you) know that you should not leave your secrets in your vehicle? If you have comprehensive insurance coverage for the vehicle (in some cases called "besides collision"), insurance coverage might cover the theft whether the keys were left in it or not. And if you're not sure whether you have extensive (or "besides accident") insurance or whether your specific policy covers the situation, check with your representative.

Leave your extra set someplace other than in your vehicle. Lock things up. Call the police, report a claim Obviously, if your automobile is taken, the very first thing you should do is to call the authorities. The 2nd thing you should do is report a claim to your insurance company.

The owner of the car may only be accountable for damages in an accident triggered by someone who was permitted to obtain the car. The thief will be responsible for the losses due to his/her irresponsible behavior. Yet his/her insurer may reject protection since their insurance policy holder was participated in illegal activity at the time the damage was caused.

Does Car Insurance Cover Theft? - Nationwide Fundamentals Explained

It might not be possible to find the thief, however even if discovered and recognized, he or she might not be covered under any insurance coverage. Automobile Insurance Coverage and Stolen Cars Whether your damages are covered will depend upon your kind of car insurance coverage. Security against theft is included in certain policies.

If your lorry is taken, some steps can assist protect your claim for payment. You do not desire the insurance provider to review your claim and think you were involved in the theft of your lorry. Confirm Your Automobile is Stolen If you can not locate your car, possibly it was towed, parked in a various area than typical, or you forgot you lent it to someone.

Make certain your car was really stolen prior to calling the police. Click for info You do not desire to be implicated of submitting a false police report. Call the Cops and Report the Theft Call the police as quickly as possible to begin the investigation procedure. An authorities report will need to be submitted with a comprehensive description of your vehicle (model, make and year), license plate, VIN number and the last location your vehicle was seen.

Does Liability Insurance Cover Theft? - Savannah Toyota for Beginners

We have actually recovered millions in payment on behalf of our clients over the years. We only get paid if you do.

Your cars and truck is recovered within the time limit specified by your insurance plan. The lorry is in the same condition it was before its theft. When your cars and truck is recuperated within your policy's time limit and is in the very same condition as before it was taken, it keeps a tidy title.

A tidy title is what ensures the exact same resale value as prior to the car was taken. However, if your car doesn't fulfill these conditions, it will diminish, and it might even become a salvage lorry. For a vehicle to end up being a salvage lorry, either the expense of repair work for the cars and truck should go beyond the vehicle's actual value, or the vehicle is returned after the insurance coverage payment has actually been made.

Fascination About Auto Insurance Myths – What's True And What's Not? - Co ...

The vehicle's next title will be described as a salvage title, even if the automobile remains in ideal condition. Formerly stolen cars with a salvage title can lose anywhere from 20% to 40% of their original worth. There are many easy actions you can take to minimize the probability of your cars and truck being stolen.