Residential Or Commercial Property Damage Liability: This pays when you struck somebody else's car, or other home and typically stays practically the samebut, you'll observe higher premium for larger automobiles (heavier) or automobiles that are older and have couple of security features like anti-lock brakes. Larger can trigger more damage hence the higher premium for heavier automobiles.

You will see the bigger or the more security functions your lorry has, the premium will be less compared to other cars without those security functions. Much safer car implies you are less most likely to be hurt and for that reason the lower premium.

These are not the necessarily the answers that folks desire to hear, but that is the reality of car insurance coverage in NH, or anywhere in the country. What we provide at Fortified Insurance coverage Firm is the ability to have us examine prices with other providers. This permits us to see if your insurance coverage program is "market right"and if we discover something priced better with commensurate protection, we'll promptly move your policy.

The Facts About Why Has My Car Insurance Gone Up? - Age Co Uncovered

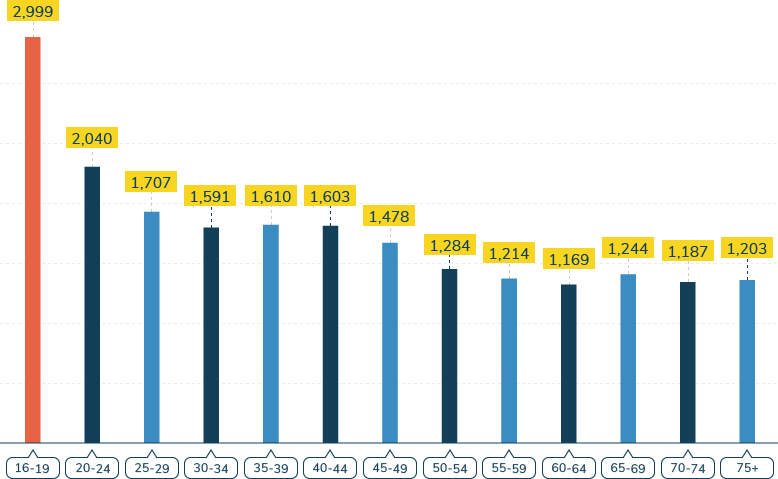

Automobile insurance does go down at 25. The average price of automobile insurance for a 25-year-old is $3,207 for an annual policy.

Our analysis discovered that rates go down a lot more at other one-year periods. Keep reading to learn more information about when vehicle insurance coverage does go down. When does cars and truck insurance get cheaper for young motorists? Supplied they keep a clean record, young chauffeurs will likely see their vehicle insurance decrease after every year driving on the roadway but just how much it in fact reduces by differs from year to year.

What age does vehicle insurance decrease for male vs female chauffeurs? Your cars and truck insurance coverage does decrease after you turn 25, however not as much as it does on other birthdays. Unless you live in a state where insurance companies can't factor gender into insurance rates, one considerable modification take place at age 25: the difference in between what male and female motorists pay for cars and truck insurance coverage.

Not known Incorrect Statements About 7 Factors That Raise And Lower Your Car Insurance Rates In Ontario

Does car insurance coverage from major national insurance providers go down at 25? We evaluated quotes from 4 of the biggest car insurer Geico, State Farm, USAA and Progressive and discovered that while automobile insurance does decrease at 25 with each of them, the quantity it reduces by differs considerably.

Unless you reside in one of the few states that have actually made it illegal, a lower credit history may increase your vehicle insurance premiums. If you move to a community with higher rates of theft and vandalism, then insurance providers will charge you greater premiums to represent the increased threat of damage or theft.

Every insurance coverage business computes rates in a different way, and some insurance provider will stress different aspects more greatly than others. We suggest reassessing your insurance provider every year to get the best rate. How to get cheaper cars and truck insurance coverage as a 25-year-old driver If you're a young motorist in your 20s, you have actually most likely wondered how to decrease your car insurance costs.

Some Known Details About 25 Factors That Affect Your Car Insurance Rate - Nerdwallet

Methods for how to make your cars and truck insurance coverage decrease By the time you hit age 25, you have actually likely passed the point where you can remain on your moms and dads' insurance coverage. (If you have not, however, you ought to definitely do so, since this is one of the finest methods for young drivers to minimize their premiums.) Luckily, there are other ways for 25-year-olds to get their insurance rates to decrease.

As your cars and truck's worth depreciates in time, however, think about lowering or getting rid of crash and detailed protection. If your cars and truck is just worth a few thousand dollars, it does not make sense to pay out for high premiums to cover a possession of restricted worth. If you're married and each of you drives separate cars, you may be able to lower your auto insurance coverage payment by, as insurance providers think about married couples more financially steady and risk-averse.

Discounts for 25-year-old motorists As you search for the best rate, make sure you're likewise asking insurer about all appropriate discount rates. Twenty-five-year-old chauffeurs might not be able to benefit from student-away-from-home or good-student policies, however there are lots of other ways these young chauffeurs can save money on cars and truck insurance: You may not have the ability to certify for a good-student discount anymore, however your university might have partnered with an insurance business to protect discounts for alumni.

Some Ideas on Shouldn't My Auto Insurance Go Down? My Car Is A Year Older! You Need To Know

By taking a, you'll not only find out how to drive more securely, but you can lower your auto insurance premium anywhere from 5% to 20%. Be advised, however, that some states and some insurers only extend this discount to elders or chauffeurs under 25. Consult your insurance provider to see if you qualify before you register for a class.

Does your cars and truck have certain security features, such as anti-lock brakes or daytime running lights? You might receive a vehicle discount because of it. Inquire about these discounts when you call insurance companies for a quote. You may be surprised at the cost savings you're able to generate simply by asking concerns.

: Your age, Your driving experience and declares record, Your credit rating, Your address, occupation, or use of the cars and truck, Your option of insurance coverage company Here are commonly asked concerns with examples of how each of these elements impacts your insurance coverage price, and when you can anticipate to get cars and truck insurance discounts or get a lower rate on cars and truck insurance coverage as an outcome.

Some Known Facts About Is It Normal For Auto Insurance To Go Up Every Year?.

For each year you do not have a claim, you come closer to gaining from a claims-free discount rate, excellent motorist discount, or preferred rates. To help your insurance coverage rate go down when you've had a claim, think about: Leveraging your insurance by combining your house and automobile insurance to get another discount rate, Taking a greater deductible to save cash (because making small claims is probably the last thing you will wish to do if you are attempting to tidy up your claims record)Consider getting a usage-based insurance coverage discount rate What About Starting a Profession or Marrying? Age is a significant consider the rate of car insurance coverage because numerous other things go hand-in-hand with age.

You might move into a more secure community, which can conserve you cash on insurance. Some insurance companies will decrease the expense of your insurance coverage or provide a discount rate if you are wed or have a household.

You do not have to stay with the very same insurance coverage business to wait for your automobile insurance coverage to go down. Does Cars And Truck Insurance Go Down With a Great Credit Score?